Welcome to Spotting the Issues, where we discuss business and legal issues impacting entrepreneurs and growing companies. I'm Emily Campbell, a real estate investor and internet entrepreneur, and the managing member of the Campbell Firm PLLC, a general practice law firm based in Manhattan. I have guest lectured at Columbia University's Lange Center for Entrepreneurship, Parsons School of Design, and the School of Visual Arts, as well as many micro entrepreneur programs. I have also been involved in business plan competitions at Columbia University's Lange Center for Entrepreneurship and Farouk's Field Center for Entrepreneurship at Fordham University. Additionally, I am an adjunct professor of law at New York Law School, where I teach drafting contracts and advising entrepreneurs. Today's discussion is on S-corporations versus LLC's. Many entrepreneurs are trying to determine whether to set up an S corporation or an LLC. We will set aside the C corporation discussion for another seminar, but today, we will focus on S corporations versus LLC's, which are typical choices for small businesses. It is important to understand and make an appropriate decision before you form your entity in order to ensure that you choose the right entity. Setting up an entity that is not the right form for you could result in more costly reincorporation at a later point. S corporations and LLC's are not identical, despite what many accountants think. There are a number of reasons for this, including the fact that both are pass-through types of entities, meaning the income or losses flow directly onto individual shareholders' tax returns. While this is a tax advantageous position for both types of companies, they each have limitations, with the S corporation having more limitations than the LLC. We will discuss these two distinctions so that you can see which corporation structure would be...

Award-winning PDF software

Llc s corp election deadline Form: What You Should Know

You will need the following documents from your business entity to properly register your corporation: The original Certificate of Incorporation of the business entity; A copy of a Certificate of Good Standing of the business entity; and, Whether the business entity has a Certificate of Public Convenience and Necessity.

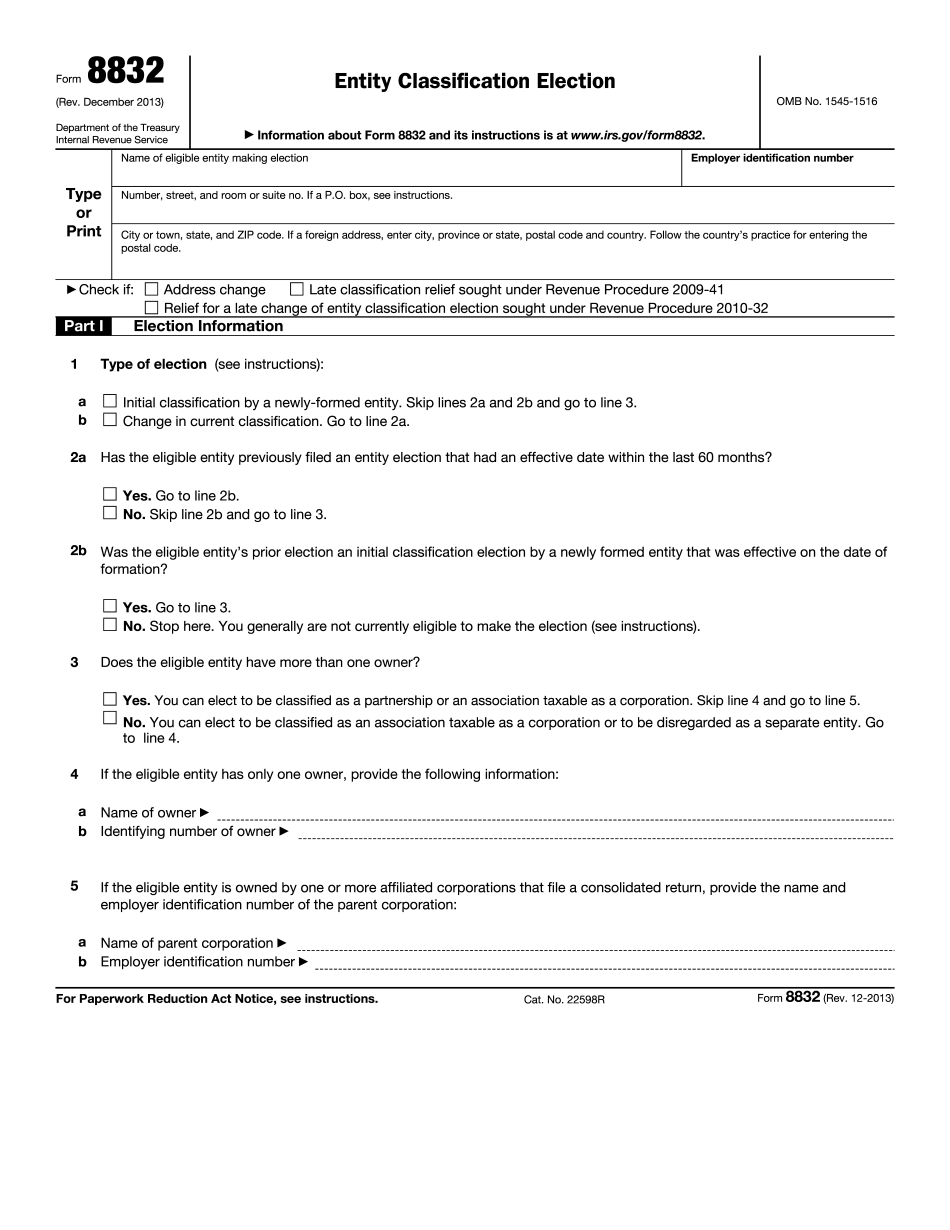

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8832, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8832 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8832 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8832 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Llc s corp election deadline