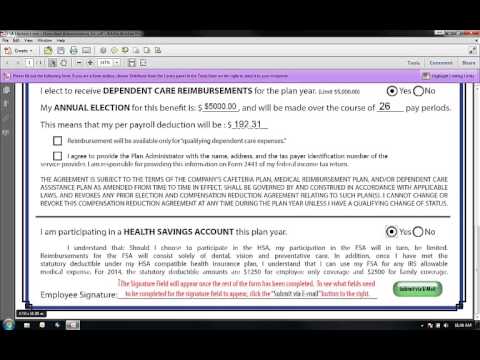

Diversified administration is proud to announce our new election form. Let me take a moment to explain some of its features. The form is customized for each employer, so the employer's name will already be filled out. The rest of the fields in the participant information section are pretty self-explanatory. Once you've completed the information in a particular field, simply hit the tab key to move to the next field. In the coverage information section, begin by putting in the date that the current plan year starts. If you're unsure of the date, either call us or your human resources department. Next, indicate whether or not you'll be participating in the medical portion of the FSA plan. If you select yes, before entering the effective date of the plan, you'll receive an alert reminding you to fill out that date. If you'll be participating in the medical reimbursement benefit, enter the amount you would like to contribute for the year. The medical limit is currently twenty-five hundred dollars. If you enter an amount higher than that, an alert will pop up and ask you to enter an amount at or below the limit. The number of pay periods will already be filled in and won't need to be changed, except by human resources when they're completing this form for people joining the plan mid-year. Based on the annual election and the number of pay periods in the plan year, the form will automatically calculate the per payroll deduction amount. Finish this section by checking the detailing the terms of this benefit. Next, indicate whether or not you'll be participating in the dependent care reimbursement benefit. Just as with the medical reimbursement benefit, enter the annual election amount. If the amount is higher than the plan limit of five thousand dollars, an alert...

Award-winning PDF software

Rev proc 2009-41 Form: What You Should Know

Revenue Procedure 2009-41, Extension of Time— TreasuryDirect Revenue Procedure 2009-41, Extension of Time— TreasuryPress Revenue Procedure 2009-41, Extension of Time — Treasures Revenue Procedure 2009-41, Extension of Time— U.S. Dept of Commerce Revenue Procedure 2009-41, Extension of Time— TreasuryPress Revenue Procedure 2009-41, Extension of Time— U.S. Dept. of State Revenue Procedure 2009-41, Exempt Organizations Revenue Procedure 2009-41 Rev. Pro. 2009-41 — OMB.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8832, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8832 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8832 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8832 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Rev proc 2009-41