P>Down Georgia veg here, author of the complete interview answer guide. Today, I'm going to answer the question for you: tell me about yourself. Just like I do inside the complete interview answer guide, I mean, what a weird start. What do they want to know? Should you start in high school, college, first grade? I mean, it's one of the most frequently asked questions in the interview. I mean, the way you answer this question is going to set the tone for the rest of the interview. I mean, this can be a challenging question to answer if you're not prepared for it, but it's really asked as an icebreaker. Like I said, this is an open-ended question, but really, what the interviewer wants to hear about is your recent work experience. I mean, why don't they just ask about your recent work experience? Because they want to see where you're going to go with an open-ended question. I mean, your answer tells them a lot. It tells them where your mind is. If you start telling them about being a Cleveland Browns fan when they ask this question, you know that you're way off base with what they want to hear and you've just made your first interview mistake. Now, what do you want the interviewer to know about you when you leave? Do you want them to know about your work experience or your personal interests? In conflict, their hiring decision is going to be based on your work experience. Save your personal interests for the water cooler after you get the job. Now, I want to tell you the wrong way to answer this question. Don't throw it back in their lap and say, "What would you like to know?" That's back. That answer has really...

Award-winning PDF software

Revenue procedure 2025 41 reasonable cause examples Form: What You Should Know

Provided by a court order or settlement, including a waiver, which provides that certain taxpayer obligations or conditions do not need to be satisfied before the entity gets classification relief. Sep 28, 2025 — Tax Chart Publishing Company, Inc. v. Internal Revenue Service Apr 6, 2025 — The Government files a petition to suspend the tax judge's final order suspending the court's order against the Tax May 3, 2025 — Tax Chart Publishing Company, Inc. v. Internal Revenue Service. May 6, 2025 — Tax Chart Publishing Company, Inc. v. Department of Treasury Sep 10, 2030 — Tax Chart Publishing Company, Inc. v. Treasury Department. Sep 8, 2035 — Tax Chart Publishing Company, Inc. v. Internal Revenue Service. Sep 2, 2036 — Tax Chart Publishing Company, Inc. v. US Department of Treasury (TI GTA). June 2, 2037 — Tax Chart Publishing Company, Inc. v. Internal Revenue Department (IRS). June 17, 2037 — Tax Chart Publishing Company, Inc. v. Treasury Department. Sep 5, 2037 — Tax Chart Publishing Company, Inc. v. Treasury Department. Sep 10, 2038 — Tax Chart Publishing Company, Inc. v. IRS. Nov 16, 2038 — Tax Chart Publishing Company, Inc. v. Treasury Department. Nov 16, 2038 — Tax Chart Publishing Company, Inc. v. Internal Revenue Department(IRS)(TI GTA). June 24, 2040 — Tax Chart Publishing Company, Inc. v. US Department of Treasury (TI GTA). Sep 13, 2040 — Tax Chart Publishing Company, Inc. v. IRS (TI GTA). Apr 17, 2041 — Tax Chart Publishing Company, Inc. v. Treasury Department(TI GTA). June 7, 2042 — Tax Chart Publishing Company, Inc. v. Internal Revenue Department (TI GTA). Jun 23, 2042 — Tax Chart Publishing Company, Inc. v. US Department of Treasury (Treasury). Jun 28, 2042 — Tax Chart Publishing Company, Inc. v. Treasury Department. (Treasury). Sep 7, 2043 — Tax Chart Publishing Company, Inc. v. IRS (Treasury). Oct 12, 2043 — Tax Chart Publishing Company, Inc. v. IRS (Treasury). Mar 29, 2045 — Tax Chart Publishing Company, Inc. v.

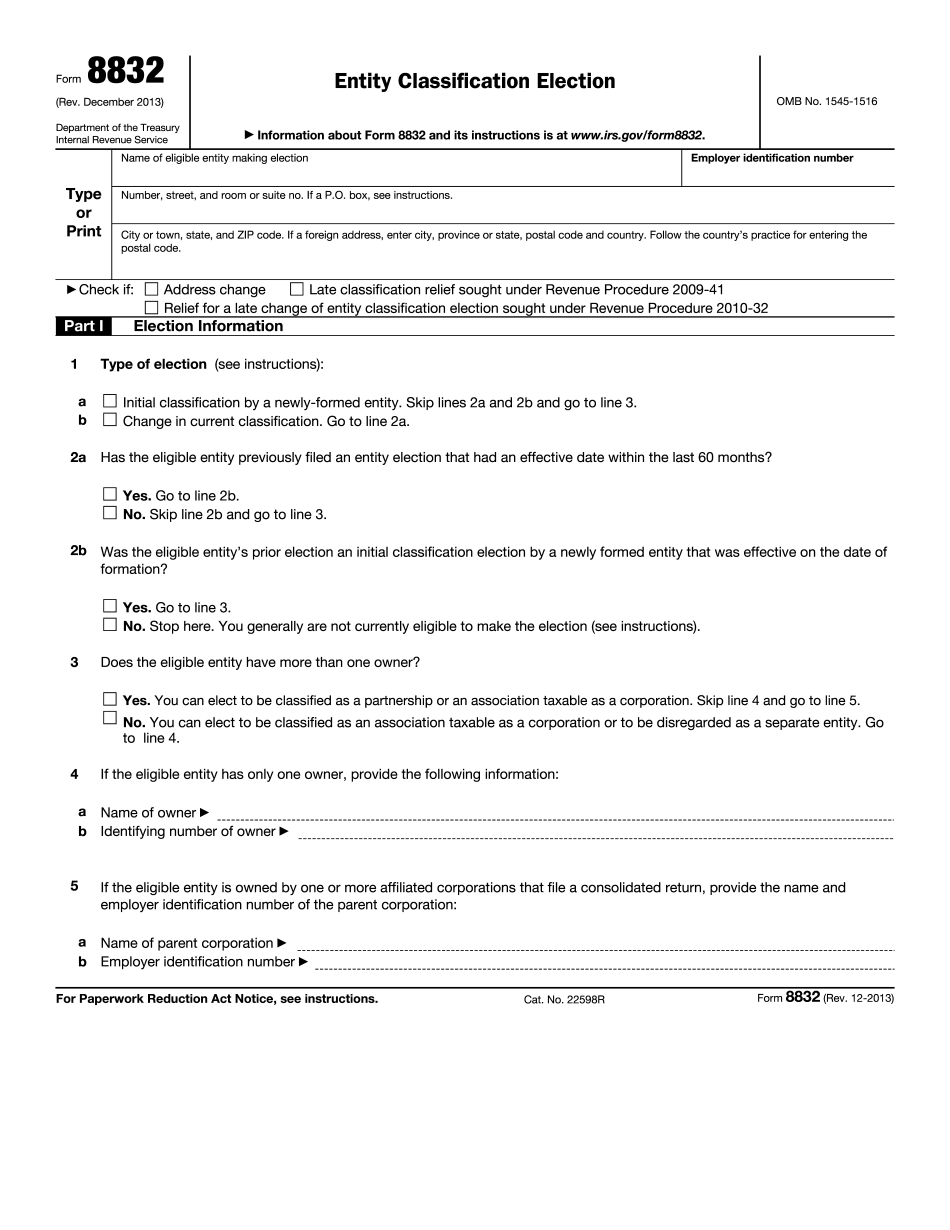

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8832, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8832 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8832 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8832 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Revenue procedure 2025 41 reasonable cause examples