Award-winning PDF software

Electing S Corporation Status For A Limited Liability Company: What You Should Know

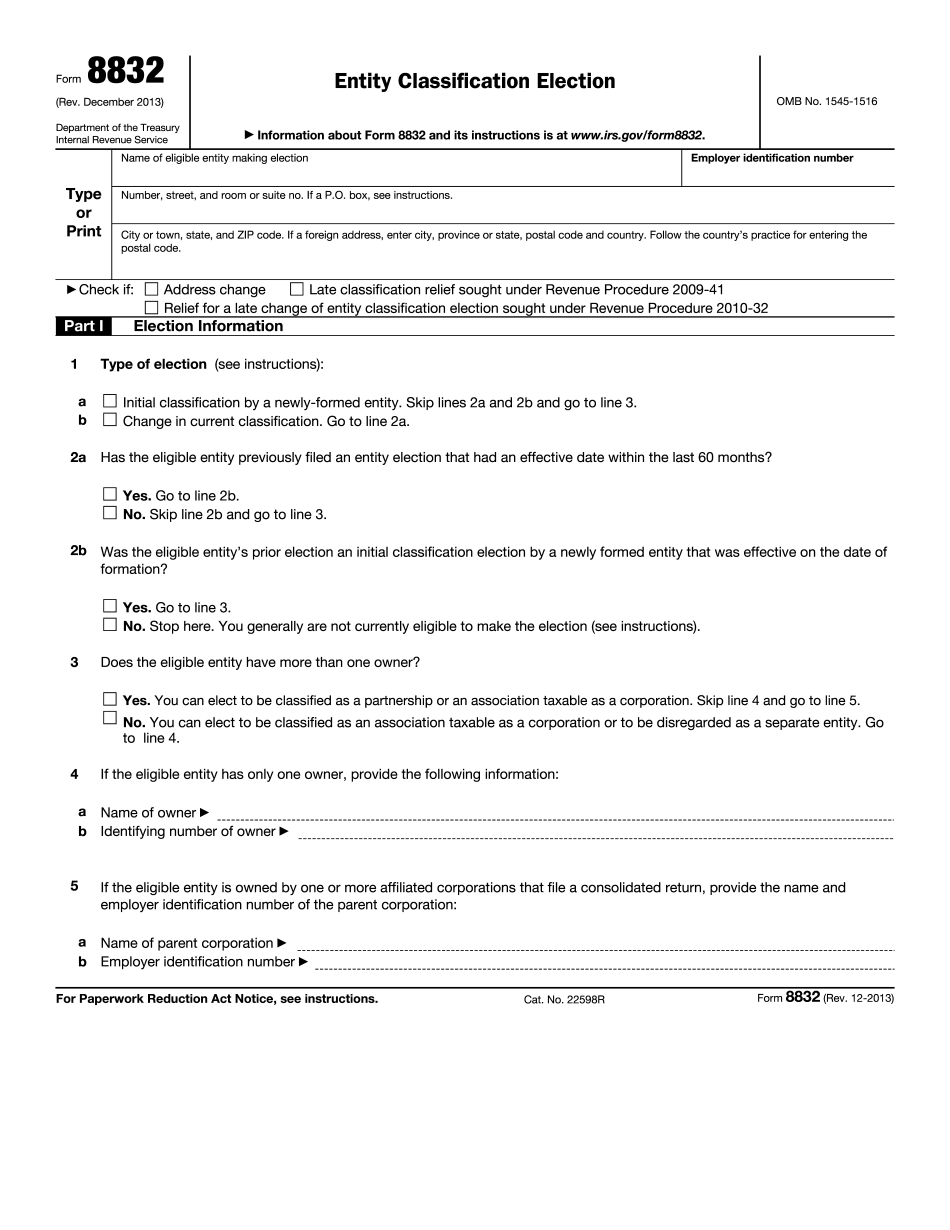

Limit of S corporation status as an LLC under the Income Tax Code: 30% After 15 years, an S corporation can elect S corporation status. LLC electing S Corp Tax Status: A Tax Plan You May Not Know In January 1997, Congress enacted the Revenue Procedures Act to change the rules for certain small businesses. The procedures, known as “the Trusts Amendment,” created new tax rules for small companies and S corporations. The procedures provided that if an S corporation elects S corporation status, then an election by an S corporation may not be made within a calendar year with respect to the same share of stock. The procedure also provided that if a taxpayer wishes to elect S corporation status, and elect S corporation status within a calendar year, an S corporation may not elect S corporation status within a subsequent calendar year without the consent of the entity. Although, the Trusts Amendment went into effect March 1999, you may also have the opportunity to make an election to S corporation status. When an LLC decides to elect S corporation status, it does so under the current rules of the income tax code. As such, the procedures apply the current rules to LCS as well as corporations. However, as noted above, a corporate election is not allowed unless the LLC member makes it. LLC Electing S Corp Tax Status: A Form You May Not Know The LLC must file a federal income tax form 1120-S, U.S. Income Tax Return for an S Corporation and S corporation laws to make the election. LLC Selecting an S Corporation Status: What You Need to Know When choosing an S corporation as an electing S corporation, the following considerations should be taken into consideration: 1) Are you a limited liability company or a corporation? a) If you are a corporation, you should choose S corporation since the income tax on the share of stock you transfer to the corporation is not subject to income tax. b) An LLC may elect to be taxed as a corporation, for tax benefits. An LLC elects to be taxed as a corporation if its members have the option to receive stock in the corporation without having to hold stock. Note: An exception to the “no stock option requirement” applies to an S corporation if the corporation has a “10% option” policy or “30% stock option policy”.

Online choices aid you to prepare your doc management and strengthen the productivity of one's workflow. Observe the quick handbook to be able to carry out Electing S Corporation Status for a Limited Liability Company, avoid problems and furnish it in a very well timed fashion:

How to accomplish a Electing S Corporation Status for a Limited Liability Company internet:

- On the website along with the form, click on Start out Now and move towards editor.

- Use the clues to fill out the applicable fields.

- Include your personal information and facts and get in touch with knowledge.

- Make certain that you just enter right info and figures in applicable fields.

- Carefully look at the subject matter belonging to the sort in the process as grammar and spelling.

- Refer to support section should you have any queries or deal with our Guidance staff.

- Put an digital signature on your Electing S Corporation Status for a Limited Liability Company when using the guidance of Indication Instrument.

- Once the form is finished, push Performed.

- Distribute the all set kind by means of email or fax, print it out or preserve in your device.

PDF editor lets you to definitely make variations on your Electing S Corporation Status for a Limited Liability Company from any net connected product, personalize it in keeping with your requirements, signal it electronically and distribute in different approaches.