Award-winning PDF software

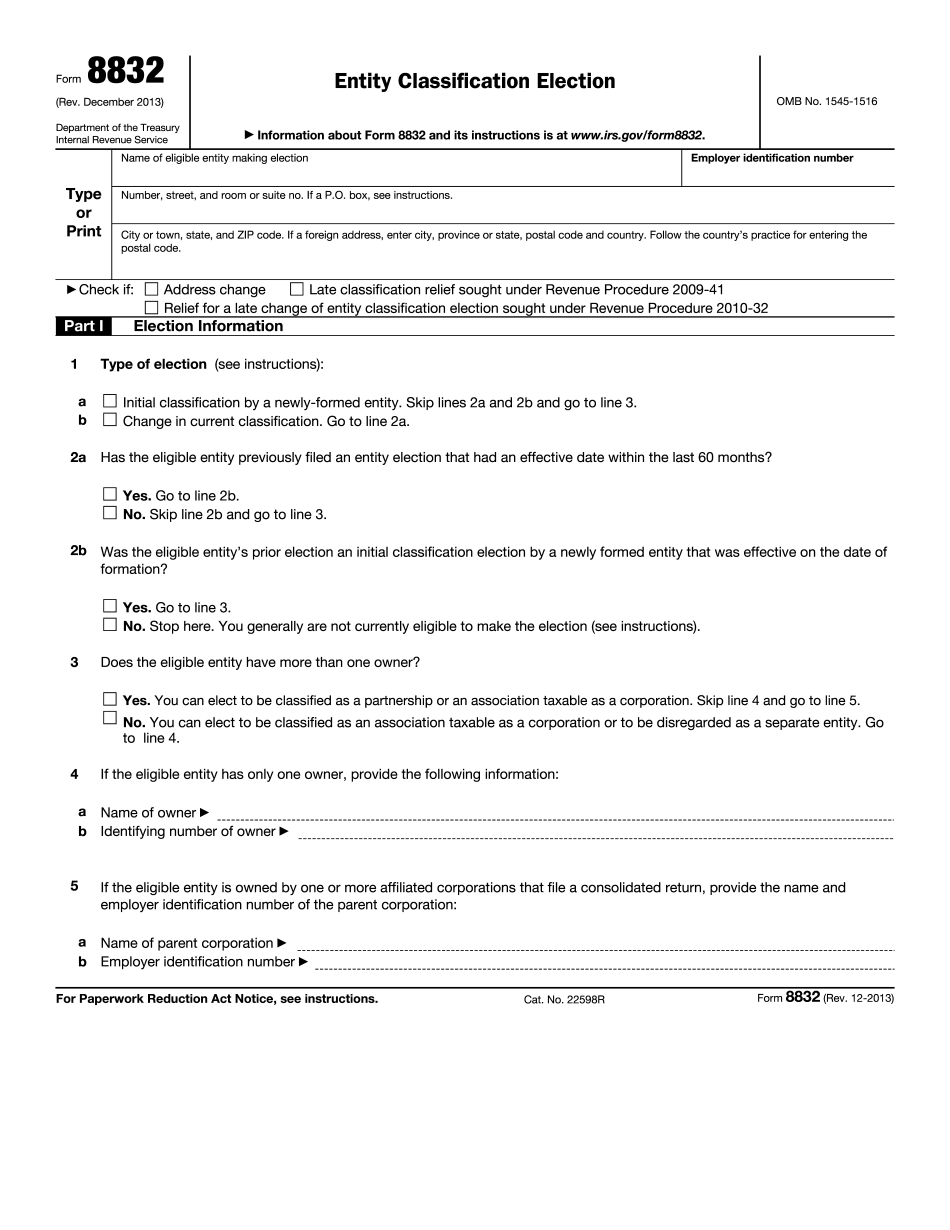

Form 8832 Online Sparks Nevada: What You Should Know

If no, what do you do if someone gets you an “illegal” Form 8832 and doesn't pay federal taxes? Are some foreign entities that try to avoid paying U.S. taxes a tax cheat or is it legal? If so, do the penalties apply? In some cases a foreign entity may be able to avoid tax by paying their U.S. taxes to the IRS and using Form 8832 to register the foreign entities business with the government, but what else may that have to do with the IRS in your area? IRS Form 8832 — Business Activity Reports- Business Entities IRS Form 8832: What you need to know — H&R Block July 12, 2025 – We talk to financial advisors, tax attorneys and other business entities experts to get more information about the IRS form 8802. IRS — Business Ownership Tax — IRS Is this a taxable transaction? Tax experts will tell you it's not a tax. “Taxpayers who obtain Form 8802 in the ordinary course of business will be allowed to deduct the business costs and expenses to the extent they are reasonable and allowed under the applicable tax laws and regulations.” U.S. “If you are not required to file Forms 8802 for your organization's business activities in the ordinary course of business, the IRS will not allow you to use them in your organization's case to receive a refund.” U.S. What to do if you get an IRS Form 8802 IRS Form 8802 : What you need to know — Investor's Business Daily May 3, 2025 — Business owners should beware of tax advisors who try to convince them that filing an 8802 on the last day of the year will mean the IRS isn't going to collect your taxes. U.S. Supreme Court v. Eu v. United States — The Court holds that no one has to file Form 8802 for an activity carried out for profit if the business was subject to ordinary tax. Who's taxed and who isn't? The law says that most people won't pay tax on wages paid to an employee. But that doesn't mean you can pay zero federal taxes on income from property sold for a profit — that just means it's reported to the IRS as business income. U.S. Supreme Court v. Eu v.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8832 Online Sparks Nevada, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8832 Online Sparks Nevada?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8832 Online Sparks Nevada aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8832 Online Sparks Nevada from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.