Award-winning PDF software

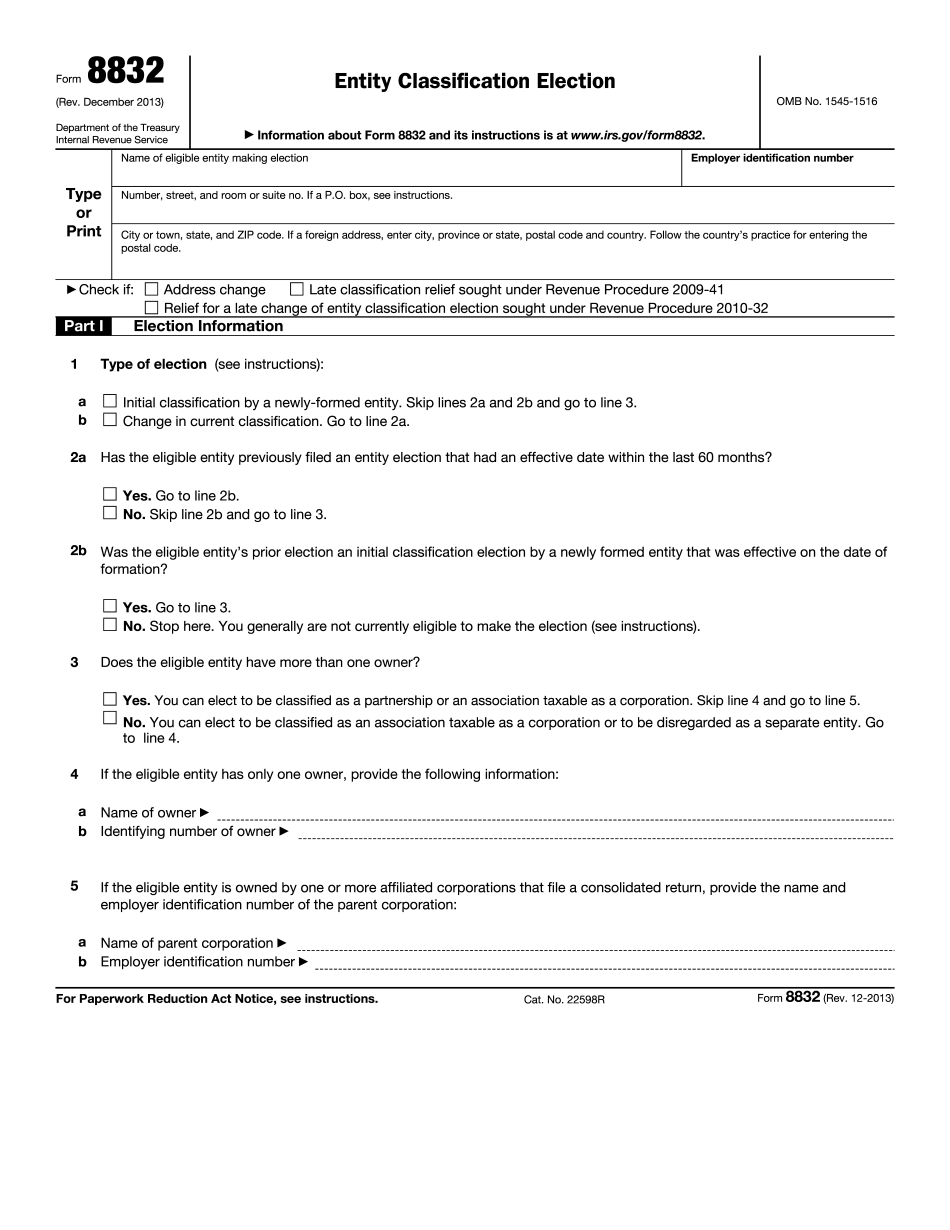

Joliet Illinois online Form 8832: What You Should Know

The LATEST BUSINESS LAW NEWS and ECONOMIC ANALYSIS from Bloomberg Businessweek. Get “A Guide to Your Economic Future. “ The latest Business Law News from Bloomberg Businessweek. Get “Business Law News and Business Economics From the Biggest Business Lawyer. “ NEW YORK STATE TAX REFORM TAX PLAN RELEASED — JOHNSON CASH, LLP A Tax Reform Tax Plan (TOP) by Johnson & Johnson, LLP, the world's largest medical device company, in its latest filing with the NY State Department of Taxation (DOT) describes major proposals to: 1 — Simplify the state's tax code by limiting itemized deductions to items such as medical expenses, state and local taxes, and municipal income taxes. The company would pay the same federal tax rate on any business profit as it does on any profit from the sale of drugs. 2 — Allow tax-exempt organizations to deduct all their charitable giving, including contributions to the arts and education. Johnson & Johnson would only allow the same deductions for charitable giving as the company itself is allowed to take for business expenses that are not income. 3 — Allow nonprofit hospitals and nonprofits to pay state and local property taxes, not just those levied against their general fund. Johnson & Johnson would not have to pay these taxes on its foreign profits from subsidiaries. 4 — Allow more tax-efficient real estate transactions. Johnson & Johnson would have the same tax rate that it pays on its foreign income — even if it were earning these profits in a tax haven. 5 — Create a new 15% capital gains tax rate for investors. Investors would pay a tax rate of 15% on all capital gains regardless of the source of the investment. MUNICIPAL PROPERTY TAX PLAN — SCHNEIDER AFFILIATE Schneider Associates, Inc. (which includes its affiliate, SAA) is the largest property and casualty insurance company in the world. A recent report of SAA's financial performance and future financial projections indicates that the company expects to invest 8.5, 7.4 and 6 percent of sales respectively, of revenue in property and casualty insurance in the fiscal years 2025 through 2024. Schneider's proposed municipal property tax plan would not adversely impact on Schneider investors.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Joliet Illinois online Form 8832, keep away from glitches and furnish it inside a timely method:

How to complete a Joliet Illinois online Form 8832?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Joliet Illinois online Form 8832 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Joliet Illinois online Form 8832 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.