Award-winning PDF software

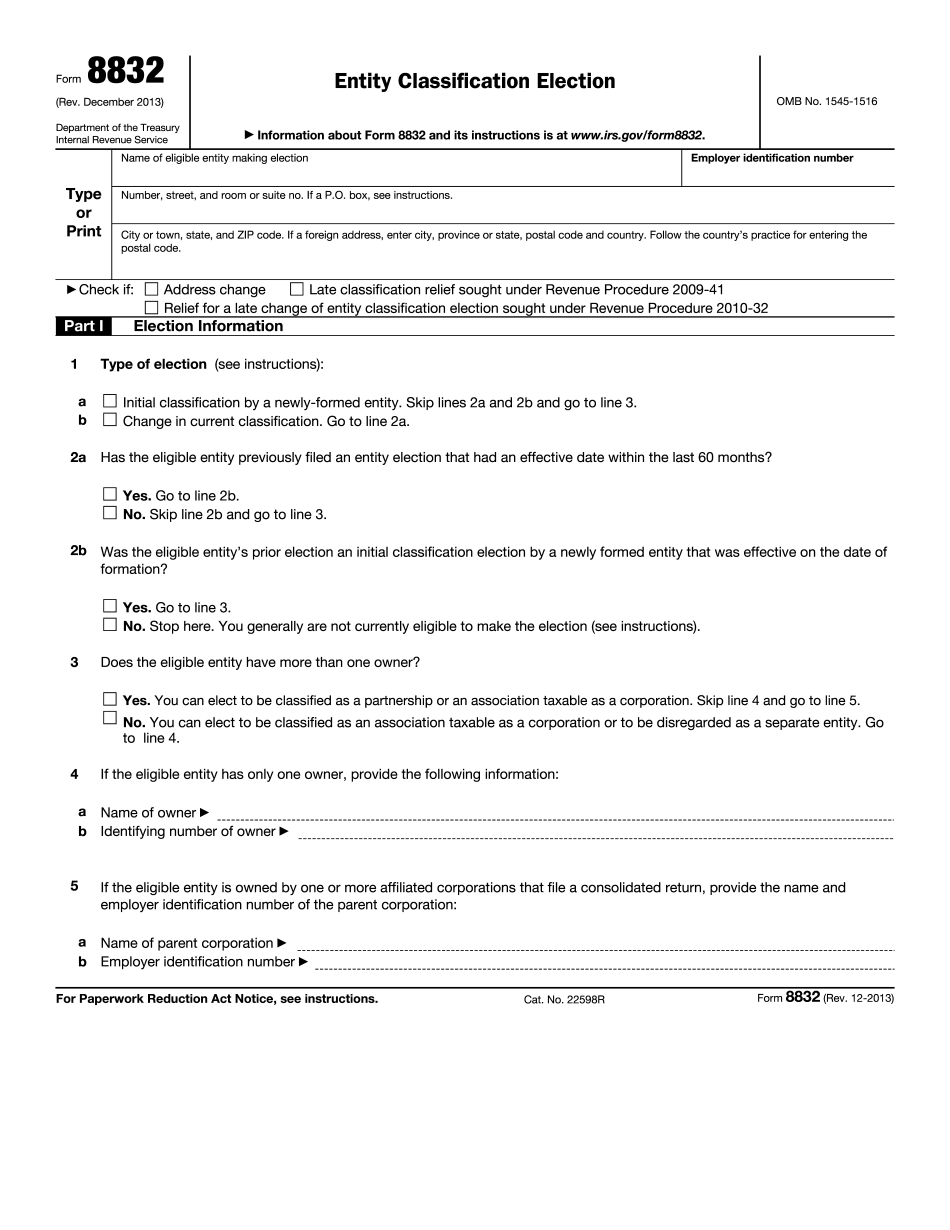

Printable Form 8832 Centennial Colorado: What You Should Know

Find your tax experts today! Who Is an Eligible Entity? An eligible entity is any company or other organization that is not taxed by the federal government. Example: An employee-owned mutual fund (in which the manager does not exercise control over the investment decisions) is an eligible entity. You must have a “share capital,” called a class of stock, that is not owned by any individual, family trust, or estate. A taxable income, or loss, of an eligible entity is any income or loss that is not reported on the shareholder's income tax return. (For more information on Shareholders, see Shareholders Guide, later.) For the definition of “taxable income” or “loss,” see Tax Guide, later. Income and Losses of an Eligible Entity If the eligible entity is not taxed, then its gross income (profit or loss) from all sources, including any gross income from the provision of services to the taxpayer, is included in its gross income from business activity for U.S. federal income tax purposes as if it had been owned directly by the taxpayer. If the eligible entity is taxable, then its gross income from all sources, including gross income from the provision of services to the taxpayer, is included in its gross income from business activity for the purpose of U.S. federal income tax purposes, including net operating loss. Example : The manager of an employee-owned mutual fund receives a salary and a bonus from the fund. The mutual fund invests and earns profit. The manager reports the net business income and the loss on a Schedule C. The annual net operating loss amount is then included in the manager's income for tax purposes. A loss or net operating income is included in an eligible entity's gross income, including gross income from the provision of services, if the manager determines the income or loss that it reports for its business is not properly allocable to that business as a whole. For more information, see Publication 525, “Accounting for Income and Loss from an S Corp or LLC,” or visit the IRS website. Business Activity That Qualifies an Eligible Entity as a Corporation or a Partnership If an eligible entity is a corporation or a partnership, the eligible entity does not have to be organized as a corporation, even if it is considered a partnership. If an eligible entity is not organized as a corporation, it is no longer considered an “entity,” unless one of the characteristics above applies to it.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8832 Centennial Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8832 Centennial Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8832 Centennial Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8832 Centennial Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.