Award-winning PDF software

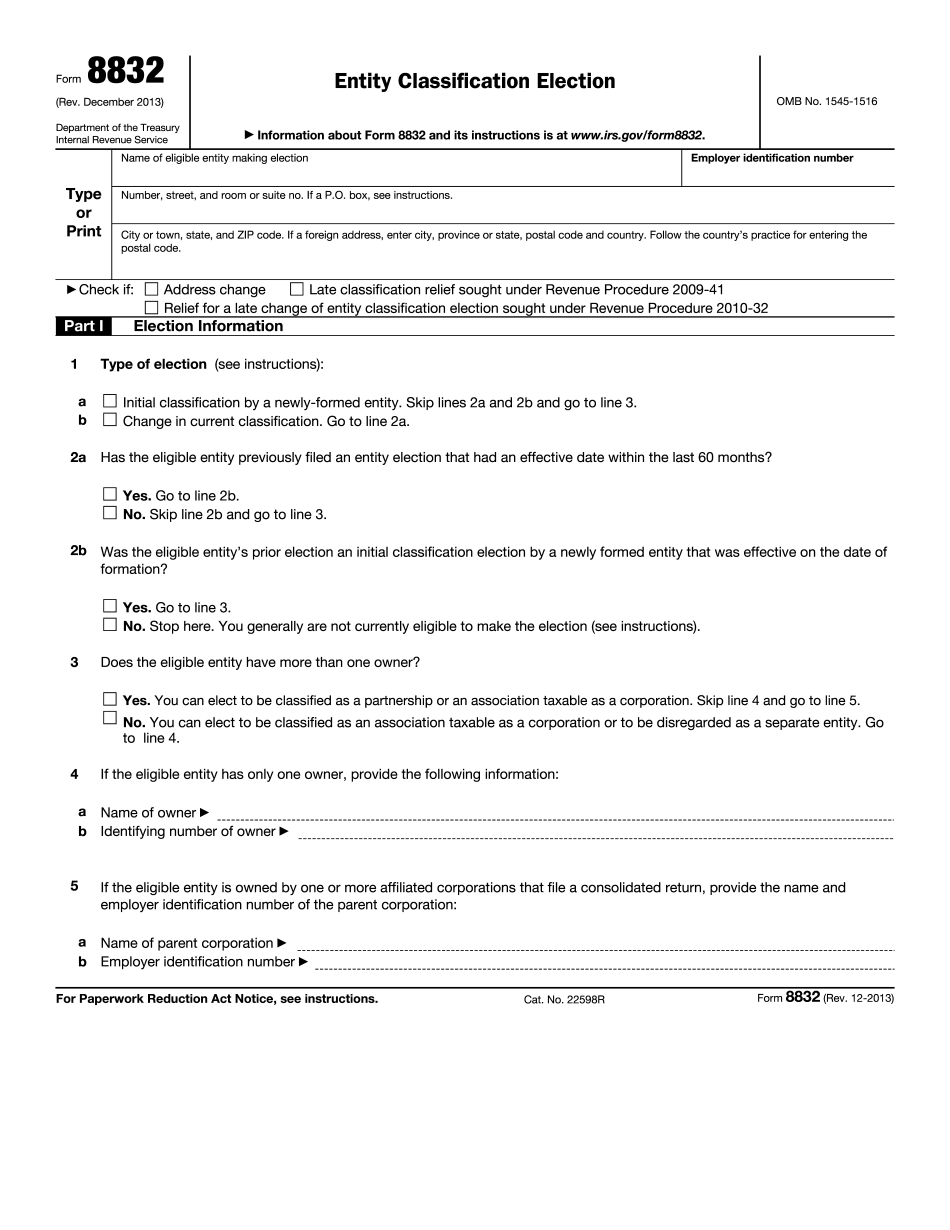

Printable Form 8832 San Angelo Texas: What You Should Know

IRS Form 8832: What you need to know — H&R Block Learn more about IRS Form 8832 and using it to classify or re-classify a domestic or foreign entity with the international tax experts at H&R Block. What is “taxation-friendly” and “tax-neutral”? — Tax Advisor Jun 1, 2025 — Taxpayers are often confused by their personal tax return's treatment of certain business activities. Some entities, or transactions, may be treated differently than others depending on the taxpayer's individual situation. The IRS published a revised guidance (tax-friendly) last year that provides some clarity regarding the interpretation of the definition of “taxation-friendly.” Specifically, this guidance is designed to be read in conjunction with the rules, if any, that apply to the conduct of business that is tax-exempt under Section 501(c)(3) of the Code, tax-neutral business activities, and related business income. Learn more IRS Form 8949: Qualified Domestic Production Activities Apr 27, 2025 — Qualified Domestic Production Activities are activities which produce income from the production of taxable domestic products or which qualify for an exemption from any tax imposed under the Federal income tax, or by any State or political subdivision or local authority. In general, this income includes income generated from the extraction of natural resources which is excluded from the gross income under section 861, but also includes those activities and properties which generate taxable income from certain qualified real property as excluded or disregarded income under section 863 and certain intangible property, but which are otherwise excluded income under section 8852 or 883. This includes income derived from the sale, exchange or rental of certain properties and certain intangible property, including business and investment income, profits derived from the sale or exchange of qualified property, the sale of intangible property (other than a small business concern that produces under 1 million per year in gross sales) which is not a qualified business asset under Section 280G or 895, income derived from certain sources of fuel, including oil produced from non-covered acreage under a conservation allowance or royalty allowance, and any other income which is excluded, or is treated differently under section 883, from other income taxed under the Code.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8832 San Angelo Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8832 San Angelo Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8832 San Angelo Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8832 San Angelo Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.