Award-winning PDF software

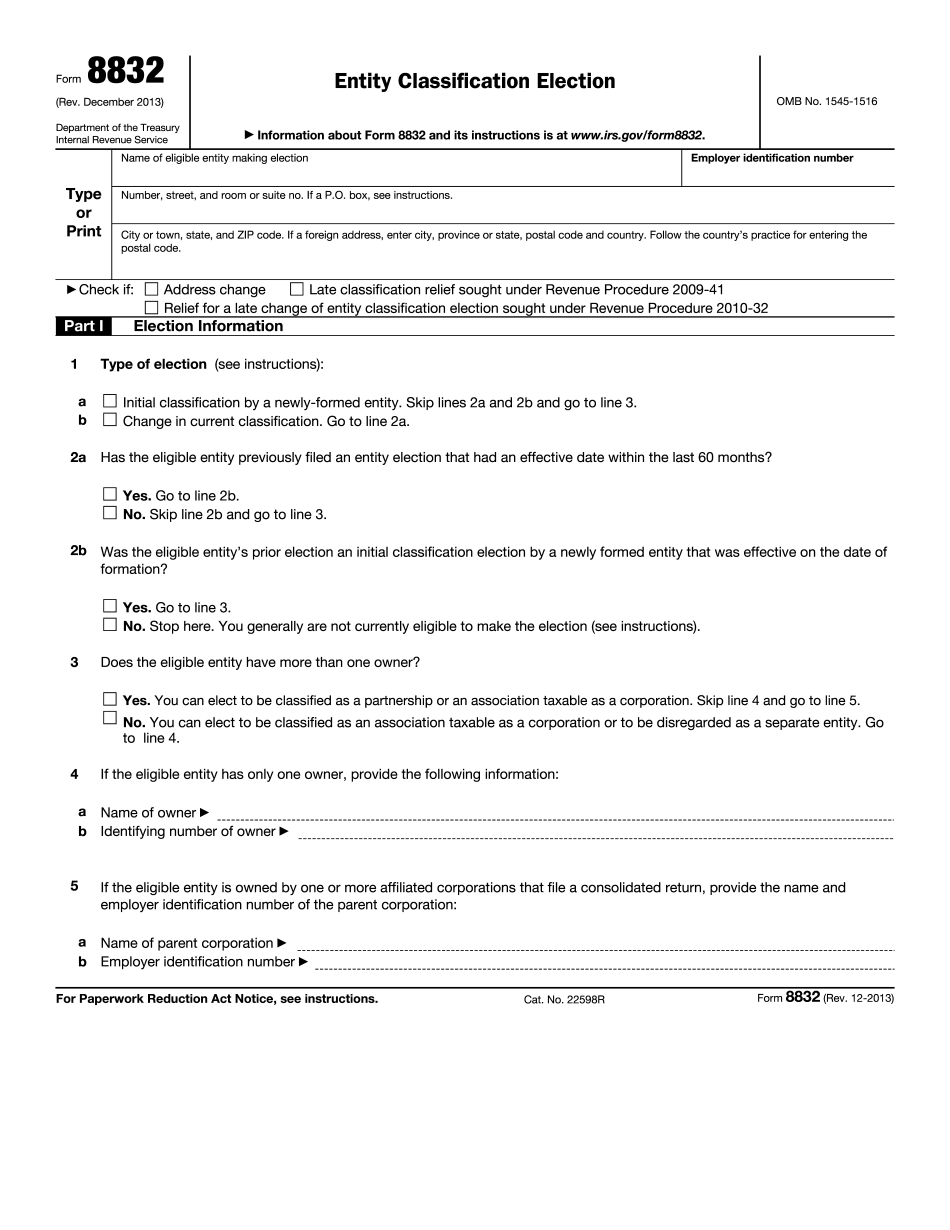

Wichita Kansas Form 8832: What You Should Know

How I can easily change to my C-Corporation's tax category by using form 8832 — Forbes Jan 1, 2025 — The easiest way to change your tax classification is to use form 8832. It is an election tool, though, so you may want to keep an eye on Form 1163 (Rev. 2013). How an LLC can easily change tax status. (Rev. 2013) Dec 1, 2025 — For a simple or large tax-exempt organization, using Form 8802 to change the group's tax status can make a huge difference in how much each member pays in taxes — Forbes. Tax-Exempt vs Governmental Exempt Organizations & C-Corps — Tax Exodus Mar 13, 2025 — Tax Exodus has compiled a comprehensive guide that describes the differences between tax-exempt and government-exempt groups and what organizations should do when applying to become tax-exempt. The guide focuses on large and complex organizations, so be sure to read it to understand the differences between small groups and tax-exempt organizations. How Do I File for an Election? (Form 8832) — Forbes Mar 20, 2025 — You don't have to wait for the deadline to make a change to your entity classification. The deadline for filing an entity classification election is the following tax year. If you file on or before the deadline, you have no deadline. Form 8832 & IRS Form 1163 — IRS Nov 17, 2025 – We discuss the difference between Form 1163 and Form 8832 in depth in the Forbes article The IRS' new Form 6833: How to Change Your Business Entity, Part I. The difference was covered in depth in the Forbes article IRS Form 8832 & Form 11038: How to exclude from Income. IRS Form 8832: What you need to know — Forbes May 8, 2025 — There is a lot more information in a Form 8832 than just how you should file it. The Form 8832 page has a very detailed statement that states: An eligible organization can make the following election for tax purposes to change the organization's classification for federal tax purposes, as: A partnership — Form 118 and 8832 (Rev. 2013) An LLC or partnership — Form 8832 and 8903 (Rev. 2013) A partnership — Form 8903 and 8832 (Rev.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Wichita Kansas Form 8832, keep away from glitches and furnish it inside a timely method:

How to complete a Wichita Kansas Form 8832?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Wichita Kansas Form 8832 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Wichita Kansas Form 8832 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.