Award-winning PDF software

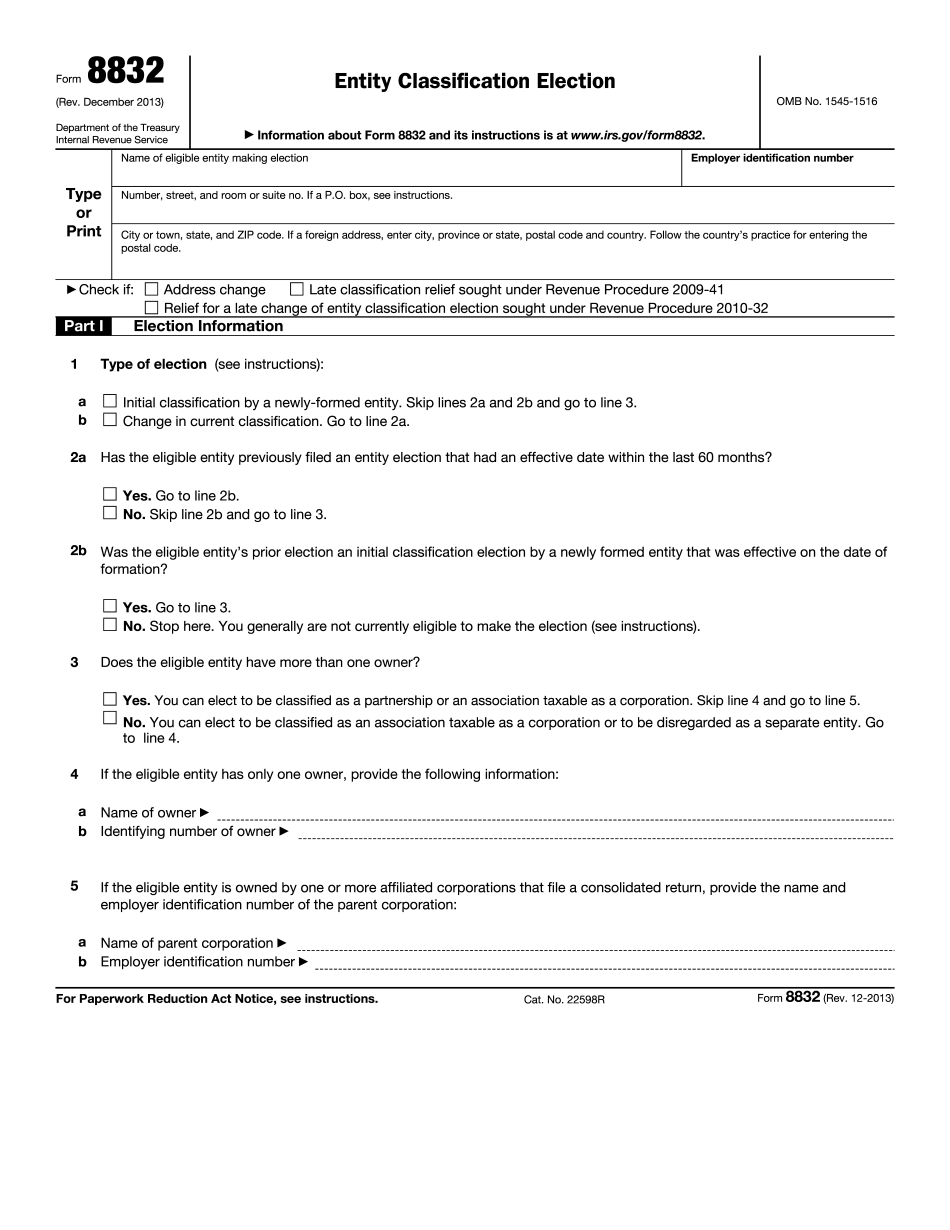

Form 8832 for Queens New York: What You Should Know

What is a New York LLC? — NYC DOE New York LC. is a corporation incorporated in New York under the provisions of the business corporations act, chapter 7-A of the general business law, and the real property tax regulations; it shall report its operations to the New York Department of State and, subject to the other provisions of such act, enjoy the same powers and privileges with other corporations, and shall be subject to the provisions of the general business law. As of the day of its incorporation, a new limited liability company (LLC) may use any name it so chooses in connection with and in connection with its business, and a limited liability company under the provisions of the business corporations act may be a name it chooses to use to identify itself in connection with or in connection with its business. Filing a New York LLC — NYC DOE If your LLC has already been incorporated, follow these instructions:1. Complete the New York corporation form, Form 83002. You will need to provide the correct filing fee, a New York LLC business license, and your financial statements. You could use Forms 83001, 83002, or 83003, depending on your state (they are similar to Form 8300). The New York filing fee is more than the form fee, so be sure to pay the fee in full.3. Form 8300 is very similar to a New York corporate form, except that it asks for the New York LLC's name, address, and contact information. If you have a NY COIN account, you must use them to file an 8300; otherwise, you must use the bank account information from your New York LLC or New York LLC's State or Federal tax return form(s) (Form 8832) or a statement attached to your New York LLC's state or federal tax return(s). The New York LLC should be located in New York regardless of its actual business location; however, New York LCS registered in New Jersey can use Form 8300 and not Form 83001. If your LLC has received a state or federal exemption certificate for New York that you believe is incorrect, contact us, and we will amend it. If an amended New York LLC form is sent to you, we encourage you to complete it (for New York LCS only). (You can view an example of a properly filed New York LLC form 8300 here.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8832 for Queens New York, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8832 for Queens New York?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8832 for Queens New York aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8832 for Queens New York from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.