Award-winning PDF software

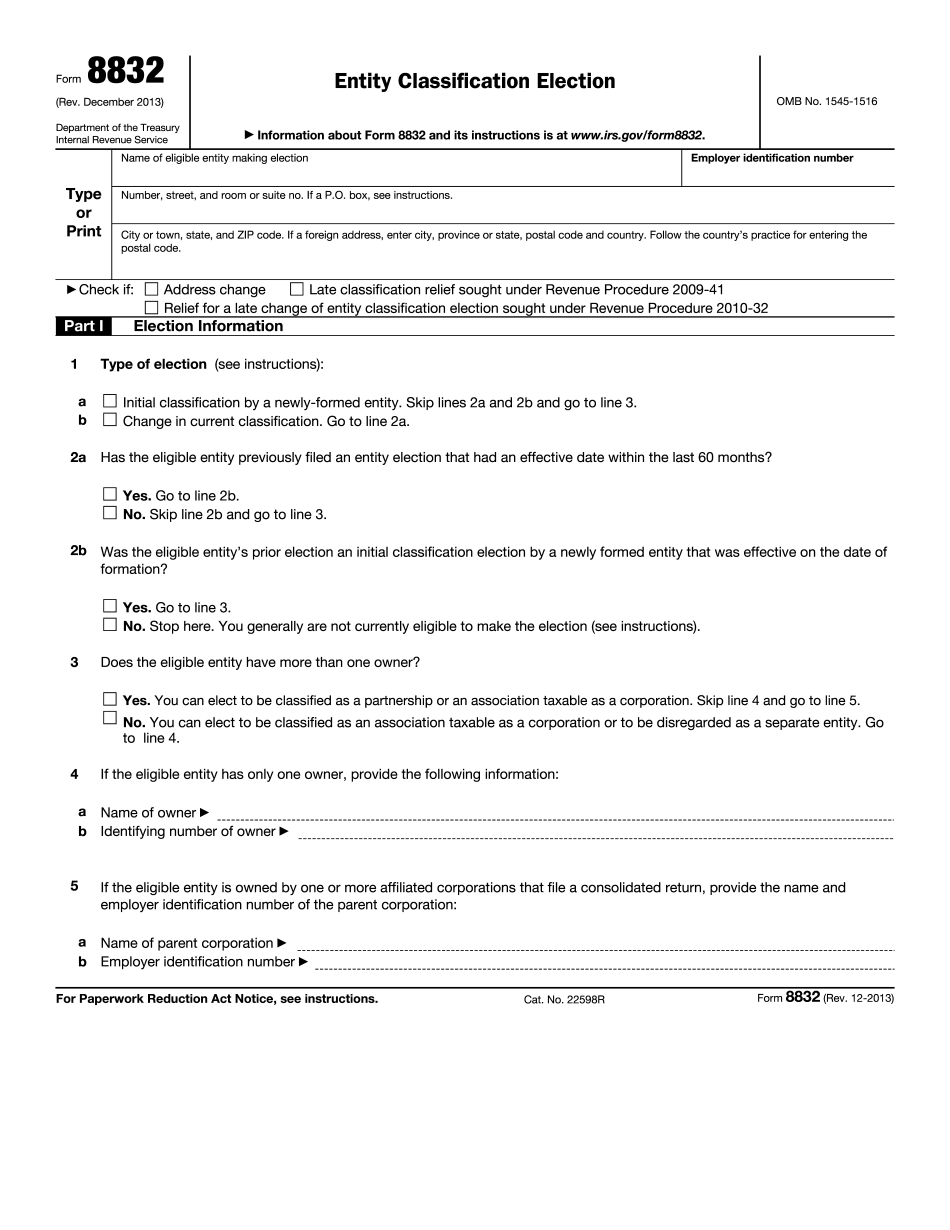

Form 8832 Illinois Cook: What You Should Know

In addition, see the 2025 General Assessment Summary Report (GA) and other reports at . Elections for Homeowner Exemption and the Homeowner Homestead Exemption are both due on or before November 15, 2018. Elections for the Landmark Exemption are due November 15, 2025. Homeowner Homestead Exemption (for homes built after 1990) — Exemptions for buildings on non-Residential property Nov 15, 2025 — A person who owns or occupies a home with a value of 1 million or greater on November 15, 2019, and who complies with the procedures outlined in Article I, Section 11 of this Act, is eligible for the Homeowner Homestead Exemption, which saves an average of more than 976.6 per year. The home must be: A single-family residence. Residential condominium. An owner-occupied condominium unit. Proprietor of a business that meets the requirements of Article III, Section 8 for which a permit was issued under the Business and Professions Code, including a manufacturer or distributor of commercial cannabis or a processor. You will need the permit information if your business intends to obtain licenses to operate under the new Homegrown Cannabis Regulation Act. Elections for the Local Zoning District Improvement Exemption (LADY) are due November 15, 2019. Local zoning districts that are subject to the requirements of Article III, Section 12 of the Business and Professions Code, including a county, city, town or village (collectively referred to as Local Zoning Districts “). You will need the notice if your business intends to obtain local licensing to operate under the new Homegrown Cannabis Regulation Act. It may be issued either through your county, city, town or village office, or directly from the county, city, town, or village administrator to the business. Elections for Homeowner Exemption and the Local Health Director Exemption are due on or before November 15, 2021. Elections for the Homestead Exemption are due November 15, 2025. Homeowner Homestead Exemption — Landowners and Owner-Occupants — 1-Million-Value homes on property where the homeowner has had an assessed value of 1-Million for 5 or more years are eligible for the Homeowner Homestead Exemption, saving an average of more than 976.6 over 5 years.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8832 Illinois Cook, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8832 Illinois Cook?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8832 Illinois Cook aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8832 Illinois Cook from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.