Award-winning PDF software

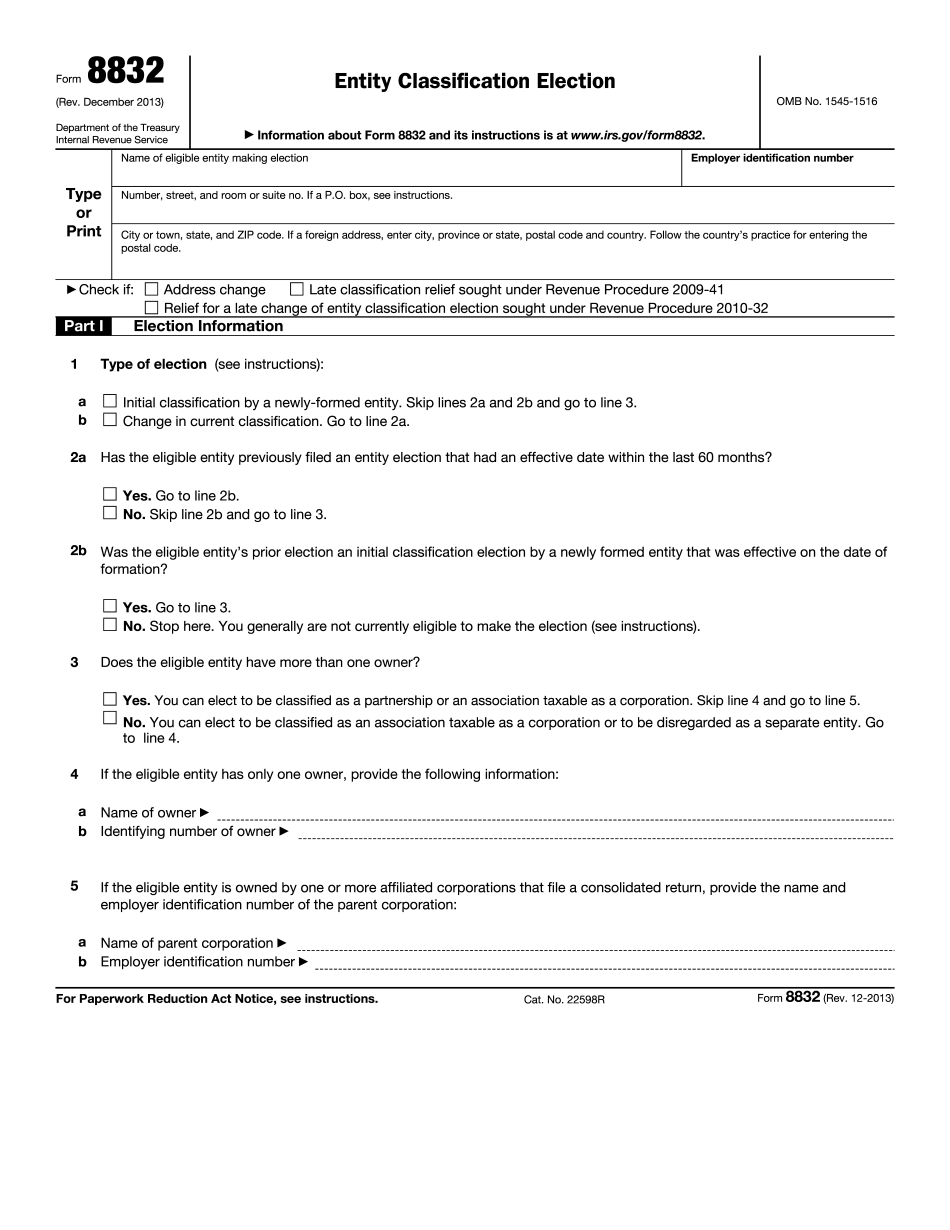

Kings New York online Form 8832: What You Should Know

The information must be posted on the county, township, or city tax agency's website at least 15 days, however, in order to be eligible for classification. These agencies include: County tax agency of the county where the entity's principal business is located. City, township or county tax office of the city, township or county. If the local agency does not provide a public website, you must contact each agency as noted above. You will also need to submit a certified copy of the IRS-approved organization certification. (Read more about electing the class to which you're entitled here.) 11-20 Business Structure & Business Activity Exemptions — Tax Exempt and Government Entities — IRS The 10 exemptions allow any business or governmental entity to receive a tax exemption from their jurisdiction's tax officials. In general, a business or governmental entity can elect to remain in that class until it no longer functions as a business or governmental entity. When the entity stops operating as a business or governmental entity, its exemption begins to expire. These exemptions come into effect for an entity's entire existence, not just during its last year. Form 8832 Instructions: A Simple Guide For 2025 — Forbes Aug 18, 2025 — This simple guide will help you understand Form 8832 instructions, which include the requirements to file Form 8832 and any requirements that apply. What if I don't elect to be taxed as an LLC? The choice between becoming an LLC or being classified as a corporation is not made by an IRS ruling. 11-30 Tax-Free Period For Tax Purposes (Transition) — IRS This transition period is good for any tax-exempt entity with certain tax-qualified property in its possession at the beginning of the tax year. It excludes, for taxable years the corporation or other structure has a balance, and is good for five years (i.e., for an entity that becomes tax-exempt for its last year to be taxed as a sole proprietor). 11-30 Exemption For Property The Corporation Controlled — IRS Individual taxpayer taxpayers can elect to be taxed as a corporation regardless of whether they are classified as an LLC. This could be a great opportunity for people considering starting an LLC or for individuals who would like to start an LLC but are concerned about losing their current tax treatment. 11-30 Election To Be Taxed As A Corporation — IRS If an entity that becomes tax-exempt for its first year is a corporation, it can elect to be taxed as a corporation.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Kings New York online Form 8832, keep away from glitches and furnish it inside a timely method:

How to complete a Kings New York online Form 8832?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Kings New York online Form 8832 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Kings New York online Form 8832 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.