Award-winning PDF software

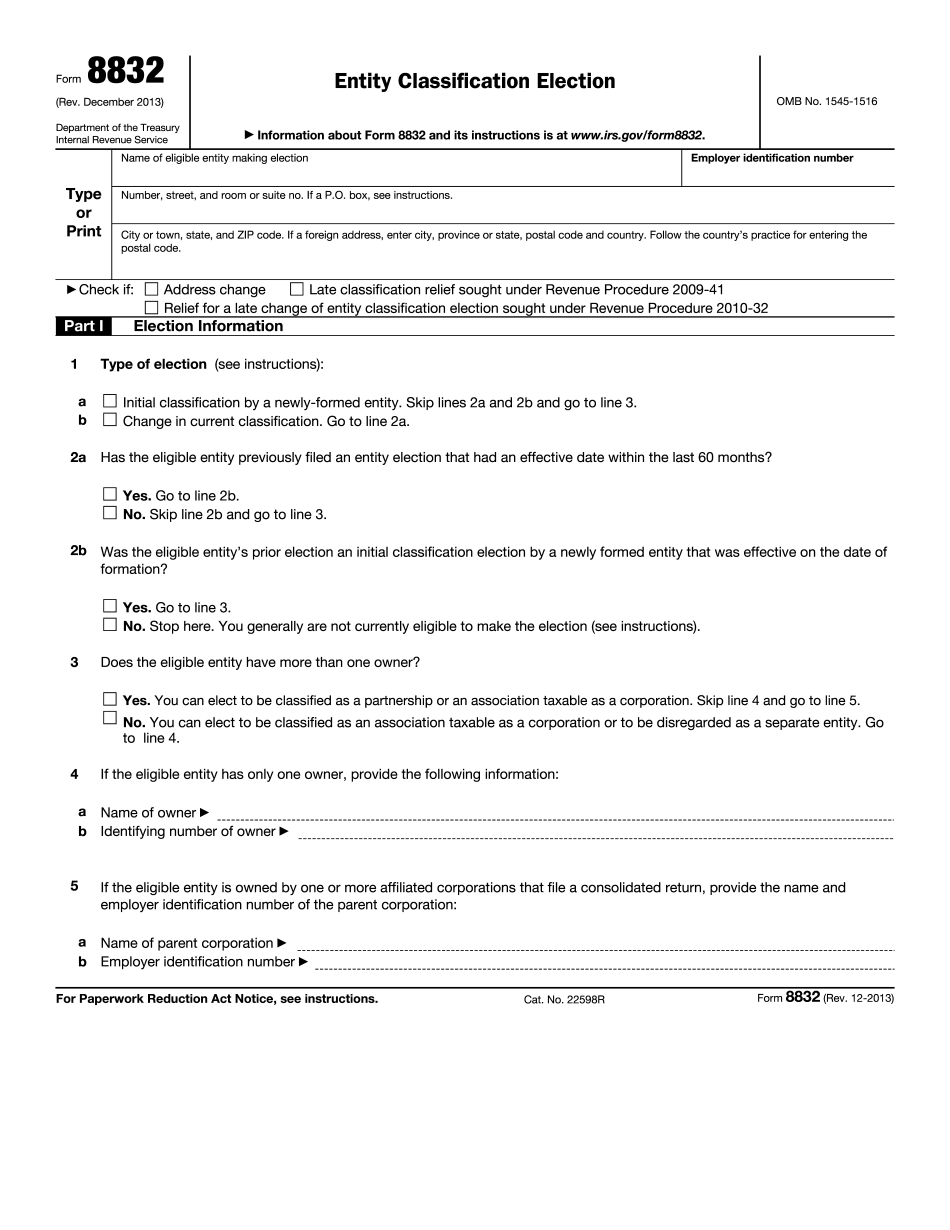

Form 8832 AR: What You Should Know

How Do I Know If I'm An entity With a Corporate Status? A sole proprietorship, C-Corporation, S-Corporation and LLP do not have to fill out Form 8832, unless: 1) A member of the LLC, C-Corp, or S-Corp owns 20% or more of any class of stock of the entity, 2) The LLC, C-Corp, or S-Corp is a public utility owned by the LLC, C-Corp, or S-Corp, or 3) the LLC, C-Corp, or S-Corp is an exempt organization. I'm an entity that makes no more than 5 million in “investments” in another entity. I have been doing nothing for more than a year on it. What is my federal status? If I make your life easier by calling you, and you simply give me an answer, that answer is a YES. If you don't know for sure, don't make this a tax obligation. If you answer correctly, I will need a signed acknowledgment that I got the answer. Don't assume it must be true, or I will do it anyway. You can get an email from me every week asking you whether I can do it for you next time, and you can refuse. In that case I will assume it is true. What is an investment? I'll use your 12,000 on the first box in column A to represent all the cash, cash equivalents (cash in your bank), short-term investments (stocks, bonds, etc) and long-term investments (bonds, certificates of deposit, real estate). I'll use your 2,000 on the first box in column B to represent any of the shares you own in another limited liability company or C-Corporation. Furthermore, I'll use the same 12,000, your cash equivalents, securities that hold a particular income stream such as interest, dividends, rental income, royalty income and long-term capital gains or losses, minus your cash. In column C I'll add this: If you have a spouse that is over 65, you will add their 500,000, your cash. What is an investment that holds interest or dividends? In column D I add your securities and cash equivalents (in columns A and B) minus the 12,000 (in column A) that represents your investment.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8832 AR, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8832 AR?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8832 AR aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8832 AR from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.